Top Ten (or 11) Year-End Reminders for Chiropractic Physicians

The list below contains many critical deadlines and important tasks for the end of 2024. Please take a moment to ensure you have all your bases covered.

- Employee Sexual Harassment Prevention Training

- FinCEN Beneficial Ownership Information Reporting Requirement

- Medical Corporations, Professional Service Corporations & Professional Limited Liability Companies

- Business Expenses

- Review Staff Compensation

- Employee Paid Time Off (PTO)

- Medicare Participation

- Contract Review

- Office Posters for Employers

- Medicare Exclusion List Checks

- Charitable Contributions

Employee Sexual Harassment Prevention Training:

Employers are responsible for ensuring that each employee (including licensees and owner-employees of corporations and LLCs) completes the training annually by December 31. It is free online through the Illinois Department of Human Rights. Here is a link to a readable presentation with a certificate, and here is a pre-recorded 23-minute video created for employees.

Chiropractic physicians can count their CME Sexual Harassment Prevention Training only in the year they took the CME course. As a result, they should take the employee version of the course in each of the other years.

Read more about this requirement here.

FinCEN Beneficial Ownership Information Requirement:

Editor’s Note: On December 26, the Fifth Circuit Court reversed its December 23 ruling below. As a result, businesses do NOT have to complete the BOI reporting to FinCEN.

12/3/2024 – A Texas Federal Court issued a preliminary injunction halting the requirement until their final ruling.

12/23/2024 – The Fifth Circuit Court reversed the lower court’s preliminary injunction that reinstated the filing requirement

12/23/2024 – FinCEN extended the reporting deadline to January 13, 2025,

12/26/2024 – Fifth Circuit Court reversed their own reversal and reinstated the lower court’s preliminary injunction and, once again, halting the reporting requirement.

Chiropractic practices structured as Medical Corporations, Professional Service Corporations, or PLLCs must comply with the Corporate Transparency Act (CTA) by filing a report with FinCEN by January 1, 2025. This includes listing beneficial owners—individuals with at least 25% ownership or substantial control, which may include senior officers or staff with significant influence over decisions. While the process is straightforward and takes about 10 minutes, practices should review staff roles carefully to determine who qualifies. Find out more about how to file this report here.

Medical Corporations, Professional Service Corporations & Professional Limited Liability Companies:

When was the last time that you renewed your entity registration? If you are unsure, you should check to ensure that it is not expired. Unfortunately, MANY chiropractic physicians have missed this step (both the original registration and the renewal) with their business entities and are out of compliance.

Significant problems could arise for those entities that have not been properly registered or renewed with the IDFPR in the past. Any unregistered entity is not legally authorized to operate, and any corporate or PLLC license registered but not renewed remains in nonrenewed status, making it also unauthorized to do business. Both situations risk challenges to your reimbursements and payments based on the billing entity being out of compliance.

Verify your business status at IDFPR (Select Medical Corporation or Professional Service Corporation and enter your entity name; then ensure that it does not say “NOT RENEWED”). If you have further questions about registration, please read this article.

Do not skip this simple verification!

Need to register or renew your business? Here is a video walk-through of the process.

Review Staff Compensation:

Minimum Wage Changes: Take a close look at your staff compensation to ensure that you remain competitive. The current labor market is challenging for hiring, and retention is more critical than ever. Additionally, ensure that you meet the legal requirement as Illinois minimum wage increases to $15.00 an hour on January 1, 2025.

Overtime Rule Update: Even though the courts struck down the new Department of Labor rules regarding overtime, chiropractic physicians should review our latest article on overtime, exempt, and non-exempt employee status to ensure they are classifying their employees correctly. You can find that article here.

Independent Contractor Requirement Changes: Additionally, if you have regular independent contractors in your practice, you should review their structure to ensure they continue to qualify as independent contractors vs. employees under the new March 2024 rules. You can find key information on those guidelines here.

Employee Paid Time Off (PTO):

Make sure your current PTO policy meets the required Illinois state minimum.

You should also be aware that if your policy accrues PTO throughout the year (i.e., you do not provide all 40 hours at the beginning of the year), then employees MUST be able to carry over their hours to the next year. For example, if a full-time employee was employed for the full 12 months in 2024 and used only 16 hours of vacation time, that employee would be able to carry over 24 hours of PTO to 2025.

Read about all Paid Leave requirements here.

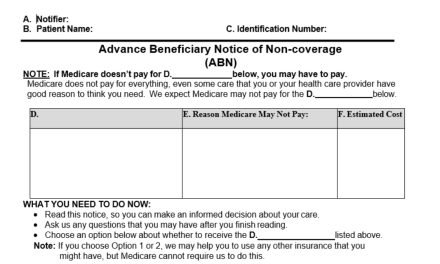

Medicare Participation:

Physicians who want to change their Medicare status from participating to non-participating (or visa-verse) must do so by December 31, 2024. Here is the link to PECOS, which is the best way to modify your participation status. If you are not changing your participation status, then you need to do nothing.

Contract Review:

Review your PPO contracts and insurance company medical policies. Now is a great time to take an inventory of the specific provisions in the contracts you have signed that affect your everyday office operations. Additionally, the ICS encourages our members to regularly review insurance company medical policies. Many of these policies are available online and searchable by CPT and diagnosis codes. Knowing precisely the terms to which you have agreed is paramount to a successful practice.

Obtain revised fee schedules from insurance carriers and review the current business impact on your practice.

Office Posters for Employers:

Take the time to update the required posters in your office. Although you may rely on posters purchased from your favorite office supply store, mandatory posters are provided free by government agencies. The Illinois Chiropractic Society has developed a checklist for your office that includes links to the necessary posters and related requirements. For a complete listing, please see our FAQ titled, “What posters/information am I required to hang in my office? Do I have to pay for them?“

Ensure you update your Statusfi compliance dashboard with these updates after the beginning of the year. You can get there by visiting my.statusfidashboard.com – Select Business, then Employment, then Employment Posters. Remember that Statusfi is entirely free to ICS members.

Business Expenses:

Pay your Illinois Chiropractic Society dues for 2025 in 2024 to take advantage of a business expense deduction for this tax year. Although ICS dues are not deductible as a charitable contribution for federal income tax purposes, your dues are partially deductible as a business expense. ICS estimates that 90% of your dues may be deductible, as the 10% reduction is due to ICS’s direct lobbying activities on behalf of its members. You can pay those dues online here.

Medicare Exclusion List Checks:

The Office of the Inspector General requires employers of healthcare workers to regularly verify that no workers are listed in the Medicare exclusion list. Workers include employees, contractors, chiropractic physicians, other providers, administrative staff, therapists, chiropractic assistants, billers, etc. Here is a list of the exclusion lists:

- OIG Exclusion Database (Medicare specific)

- System for Award Management (SAM) (Other Federal Programs)

- Illinois HFS Provider Sanction Search (Illinois Medicaid)

OIG recommends verifying employees every month. To find out more about this, read the full article here.

Charitable Contributions:

If you are determining where to make your last-minute charitable donations for 2024, you can consider contributing to the Future of Chiropractic Strategic Plan through their charitable arm (primarily for research) here (you can also see the complete plan on that website).

Additionally, ChiroCongress Cares and the Foundation for Chiropractic Education (501(c)(3), sister of the Foundation for Chiropractic Progress) are both worth considering.