Important Changes for Chiropractic from the New Relief Package (Consolidated Appropriations Act of 2021)

The Consolidated Appropriations Act of 2021 (including the latest stimulus package) addressed several issues that will impact chiropractic physicians. The ICS has worked and is continuing to work with other key stakeholders and reviewing the 5,592-page bill’s full impact.

The items of interest include: Medicare Fees (some relief for the looming cuts), Paycheck Protection Program changes (non-taxable and calculation of revenue changes), small Provider Relief Fund changes, Section 2706 Non-Discrimination rulemaking requirements (a welcome change), and surprise billing restrictions (apparently limited impact).

Medicare Fees

Since August, the Illinois Chiropractic Society has been requesting action from doctors around Illinois regarding the looming Medicare Fee cuts. To see the most recent call to action with some background, click here.

Congress attempted to address providers concerns with the new relief package. Unfortunately, Congress only partially assisted providers with these Medicare fee cuts in the Consolidated Appropriations Act of 2021. Here are the three changes that impact Medicare reimbursement:

Small Increase to 2021 Fee Schedule – This legislation apparently increases, by 3.75%, the previously released 2021 fee schedule with the 10% average cuts for chiropractic physicians. The end result will be an average 6.625% reduction from the 2020 fee schedule. However, due to the slightly ambiguous nature of the bill’s language, some experts believe that the fee schedule cuts may only be 3.8%. Once Medicare has released the new fee schedule, we will notify ICS members.

As a result of these pending changes to the Medicare fee schedule, we are recommending the following:

Participating Providers: If you are a participating provider for Medicare, we encourage you to continue to bill Medicare at your normal fees. Your bills will be processed based on the appropriate fee schedule once it is released.

Non-Participating Providers: If you are NOT a participating provider for Medicare, we recommend that you wait to submit your bills until the correct schedule is released. However, based on the information we have, you may be able to process your claims using the currently published 2021 rates and inform your patients that additional amounts may be owed or require refunding.

New HCPCS Code G2211 – As a part of the 2021 E/M changes, CMS-developed an office-visit complexity code, G2211. Congress estimated that this addition would cost CMS approximately $3 billion and made up 30% of the budget neutrality hit that necessitated the fee cuts. This legislation delays the implementation of that new code until 2024 (three years). This change MAY further lower the 2021 Medicare fee cuts.

Medicare Sequestration – At the beginning of the pandemic, the CARES Act suspended the 2% Medicare sequestration reduction. This legislation provides for another three-month delay of these payment reductions, through March 31, 2021.

Paycheck Protection Program

There are several important changes to the Paycheck Protection Program (PPP) loan forgiveness program in this legislation. If you will remember, the ICS notified doctors in September that the SBA and the IRS made policy changes detrimental to the program.

Taxing of Allocated Expenses – Congress forced the IRS to revert their previous ruling that the expenses used to cover the forgiven PPP loans would be taxable. Now, neither the forgiven amounts nor the allocated expenses will be taxable. In short, the bill states, “no deduction shall be denied, no tax attribute shall be reduced, and no basis increase shall be denied, by reason of the exclusion from gross income provided.”

No EIDL Reduction – Previously, the PPP forgivable amounts were to be reduced by the EIDL loan advanced funds. This law reverses that decision, and EIDL loan advances will NOT reduce your PPP reduction.

PPP2 – Additional funds ($285 billion) will be available for first-time borrowers, certain previous borrowers, and previous borrowers who could have borrowed more under the new rules. There are specific requirements for each of these allocations, and as the SBA develops the provisions in the coming weeks, the ICS will release more information to assist doctors with the new process.

Provider Relief Funds

Potential new money – The new legislation adds $3 billion to the fund and directs HHS to release more of CARES’s original allocation. However, it did not provide particulars, and we await HHS information on the next phase of Provider Relief.

Calculation of Revenue – As you may remember, HHS announced in September that providers would have to calculate losses based on lost net income rather than revenue, as previously indicated. For some providers who took aggressive cost savings approaches, this policy may have forced a return of funds. However, Congress reversed that policy and now requires the calculation to be performed on lost revenues. Additionally, they indicate that providers can use lost revenues vs. budged 2020 revenues instead of 2019 only.

Taxing of Relief Funds – As the ICS previously announced and addressed with Congressional Leaders, the IRS ruled that Provider Relief Funds are taxable. It appears that Congress did not address this problem, and the funds remain taxable.

Non-Discrimination

Section 2706 of the Affordable Care Act provided non-discrimination protections for many providers. However, due to the ambiguous language and lack of a federal rule to provide a full explanation and requirements, the protections have not been enforced. The ICS has attempted (and continues to pursue) these protections with the Illinois Department of Insurance, but we have been unsuccessful due to the lack of federal rules.

This law now requires HHS to implement rules for non-discrimination by the end of 2021. Once released, the rules will go through the normal comment period and become final no later than July 1, 2022. The Illinois Chiropractic Society will monitor this process very closely and work with our coalition of state chiropractic associations along with national associations to protect the interests of chiropractic physicians.

Surprise Billing Restrictions

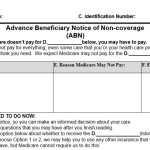

Although the surprise billing issue primarily impacts non-participating providers in hospital settings, requirements outlined in this legislation may require some small adjustments for providers in private, non-emergency settings. This legislation addresses and prohibits surprise billings to patients beginning in 2022.

The ICS will keep our members up-to-date as HHS clarifies the details throughout 2021.

This information can also be found in our COVID-19 article. For more information regarding COVID-19 click here.