PAID SICK LEAVE AND TAX CREDITS FOR CORONAVIRUS-RELATED EMPLOYEE LEAVE — DOL EXPANDS ELIGIBILITY OF PHYSICIAN OFFICE EMPLOYEES

Editor’s note: This information is part of our “COVID-19 In the Chiropractic Physician Office” article that contains important information and details regarding COVID-19. That article can be accessed here.

Executive Summary

The Families First Coronavirus Response Act (FFCRA) requires many employers to pay employees for sick leave related to COVID-19 in specific situations. Although there are exemptions for healthcare, the Department of Labor (DOL)has recently changed its rules to make the definitions less broad. In short, some of your employees will be eligible for this sick leave (required) and some may be exempted. If you are required to provide the paid sick leave, you are also eligible to receive reimbursement for payments made to employees for COVID sick leave. Additionally, as the employer you can choose to provide COVID sick leave even for those who are exempted from FFCRA.

The following list summarizes employee eligibility for FFCRA Sick Leave Pay, based on duties the employee performs in your office:

- Reception only – Eligible for FFCRA Sick Leave Pay

- Billing only – Eligible for FFCRA Sick Leave Pay

- Reception and Assists with Health History and Screening – Rules are uncertain as to Eligibility

- Reception and Administration of Modalities – Can be deemed ineligible by employer

- Administration of Modalities only – Can be deemed ineligible by employer

- Administration of other Delegated Direct Patient Care – Can be deemed ineligible by employer

- Associate physician – Can be deemed ineligible by employer

- X-ray technician (i.e. Limited Rad Tech) – Can be deemed ineligible by employer

The full article below explains COVID Sick Leave eligibility issue in detail, along with your requirements as clinic owner/ employer.

Full Explanation and Details

The FFCRA provides relief for both employees and employers affected by Coronavirus. Affected full time employees can receive up to two weeks (80 hours) of paid sick leave, at either 100%, 80%, or 2/3 of their regular pay, depending on the reason they are unable to work. (Click here for DOL’s instructions, including calculation of amount of paid leave and eligibility: https://www.dol.gov/agencies/whd/pandemic/ffcra-employee-paid-leave). Part time employees are eligible for leave for the number of hours that the employee is normally scheduled to work over the leave period to which they are entitled. For example, an employee who works 20 hours per week can receive up to two weeks, or 40 hours, of paid sick leave.

However, employers are to receive full reimbursement for amounts paid for this type of leave, in the form of an immediate dollar-for-dollar tax offset against payroll taxes. Where a refund is owed, the IRS will send the refund as quickly as possible. These provisions apply to employers of less than 500.

There are two potential exemptions: one for healthcare workers and one for small businesses under 50. The principal exemption for our doctors would be for healthcare workers. In the original version of the rule, “healthcare workers” was defined very broadly, which allowed physician offices to deny Coronavirus-related sick leave to anyone employed at the office. It included not only medical professionals but persons who are necessary to keep the office supplied and operational. This version of the healthcare worker definition has been challenged in court as overly broad.

In response, the Department of Labor (DOL) issued a rule revision on September 11, 2020, that narrowed the exemption and expanded the types of employees who can claim this type of leave. This revision may affect physician offices who employ administrative and other personnel who have no patient care duties; i.e., these offices may now be required to provide COVID-related paid leave to those employees. The news release summarizing the revised rule can be found here. For the detailed revision published in the Federal Register, click here.

Physician offices may still exempt employees who are “healthcare providers” under the new definition, which includes only employees who “provide diagnostic services, preventative services, treatment services or other services that are integrated with and necessary to the provision of patient care which, if not provided, would adversely impact patient care,” or those employees who qualify as “healthcare provider” under the Family and Medical Leave Act regulations. Generally, providers under the FMLA are licensed providers, including physicians and other licensees. The question for most chiropractic physician offices pertains to the other category — which types of employees, including unlicensed employees, are included in those who provide diagnostic, preventive or treatment services, or other services that are integrated with patient care.

The DOL has provided some guidance to help interpret the new rule. First, DOL explains that included within the definition are licensed personnel as well as unlicensed technicians and assistants, and any other persons who directly provide diagnostic, preventive, treatment services, or other services that are integrated with and necessary to the provision of patient care are health care providers. However, “health care providers” also include employees who may not directly interact with patients, but nonetheless provide services that are integrated with and necessary to patient care. For example, a laboratory technician who processes test results would be providing diagnostic health care services, even though the technician does not work directly with the patient, because the services are nonetheless an integrated and necessary part of diagnosing the patient and thereby determining the proper course of treatment. DOL gives another example of performing an x-ray as integrated into diagnosing a broken bone.

On the other hand, DOL says that Individuals who provide services that affect, but are not integrated into, the provision of patient care are not covered by the definition. DOL provides a non-exhaustive list of examples that includes information technology (IT) professionals, building maintenance staff, human resources personnel, records managers, consultants, and billers (in a hospital setting, the list also includes cooks and food services workers). While the services provided by these employees may be related to patient care—e.g., an IT professional may enable a physician to maintain accurate patient records—they are not considered to qualify as integrated and necessary components of actual patient care.

Applying this guidance to a chiropractic physician office, receptionists and billers who perform only administrative tasks do not appear to fall under the definition of “health care provider” and would thus be eligible for COVID leave. However, a receptionist who also screens patients or assists in taking their health histories is less clear. DOL has not specifically provided a statement on those employees, but if such an employee requests COVID leave, the employer could deny the request and argue that their services are integrated with and necessary to the provision of patient care. However, without specific cases or opinions at this early stage, of the rule, the ultimate outcome of the request cannot be predicted.

Click here for a link to DOL’s FAQ “Who is a “health care provider” who may be excluded by their employer from paid sick leave and/or expanded family and medical leave? [Updated to reflect the Department’s revised regulations which are effective as of the date of publication in the Federal Register.]”

To minimize the spread of the virus associated with COVID-19, DOL encourages employers to be judicious when using this definition to exempt health care providers from the provisions of the FFCRA. For example, an employer may decide to exempt these employees from leave for caring for a family member, but choose to provide them paid sick leave in the case of their own COVID-19 illness.

The second exemption indicates “An employer […] with fewer than 50 employees (small business) is exempt from providing (a) paid sick leave due to school or place of care closures or child care provider unavailability for COVID-19 related reasons and (b) expanded family and medical leave due to school or place of care closures or child care provider unavailability for COVID-19 related reasons when doing so would jeopardize the viability of the small business as a going concern.” Department of Labor gives specific requirements in the document. At this time, it appears this exemption is self-determined by the employer. The ICS suggests our physician employers who claim this exemption run some basic calculations as to the projected cost of providing additional COVID-19 sick leave to document that it would jeopardize the office’s financial viability.

Note that although employees may be exempt from paid leave for COVID-19, they are still entitled to take ordinary accrued sick and vacation leave (if any) in accordance with the physician office’s usual policies.

Also note that employers are eligible to receive reimbursement for payments made to employees for COVID sick leave. The IRS issued a release summarizing in easy-to-understand terms the law’s provisions about paid leave, employer credits, prompt payment, and small business exemptions, with links to detailed information. Here is the FAQ from the IRS on how to claim the credits (including collecting them in advance).

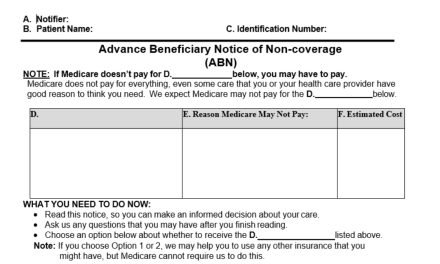

Employers must post the Families First poster at their places of business. Download the poster here. The ICS has also provided an optional notice that physician employers may use to notify their staff that some employees of healthcare offices are exempt from receiving additional sick leave. Physician employers may post this notice or print in the form of a letter to hand to staff. Although this notice is not required, providing it may be useful to advise ineligible employees of the reason they will not receive paid leave under the Families First Act and to remind them that they may still avail themselves of the office’s usual and customary policies for sick leave and vacation. Download the notice here.