Do You Bill All Physicians Under the Same NPI?

Are you billing all services in your practice under the same NPI? This week we dig into the issues that could result if you bill all services from your practice under the same NPI. Watch the video to learn more!

Transcript:

We get a number of calls from new doctors who are starting their own practices, maybe they weren’t associates before and they are talking to us about hiring new associates and how that billing process works. And we’re seeing this come up again, again, and again. We’ve seen it over the years, but we’ve seen a growing trend over the last couple of years, and how all of this works. In short, what we’re going to talk about is using your NPI as the principal chiropractic physician to bill for all services performed in your practice, even those performed by other physicians. That’s an important distinction. Of course, we can talk about delegation, we’ll briefly do that. But when you’re billing other physician’s works or exams, adjustments, et cetera, under your NPI in box, 24 j. So we are talking about the rendering provider box 24 J portion of the claim form, I’m going to give the executive summary for this entire video, it’s going to be really short. Don’t do it. That’s the short version of exactly what we’re going to talk about in today’s video. Do not bill other physicians work under your NPI in box 24 j.

Now, why is that? Well, there are a number of things that come into play, especially when we get this question. Well, but what about delegation, I delegate to to unlicensed and licensed staff. Why can’t I delegate and just say that it’s delegation? Well, there are a number of reasons, but I’ll just cut to the chase. The Medical Practice Act in its delegation provisions only allows you to delegate certain tasks, and in fact, specifically, it says, No physician may delegate any patient care tasks or duty, that is statutorily, or by rule mandated to be performed by a physician. We can cut to the short chase here, and that is exams, X-rays, and adjustments, obviously, those are required to be performed by physicians, of course, x rays, you can have certain specifically qualified staff that may be able to do that as long as they’re properly certified by the state, but I’m talking really exams and adjustments, and we see this a lot, where they’re billed under a single providers NPI.

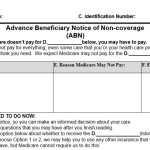

Now, this is done sometimes to avoid the short-term hassles or delays in regards to credentialing for a new doctor that may be coming on, and some of the processing delays there. But in short, don’t do it. So one delegation, we covered that. Additionally, this is really important. Whenever you put that in there, what that line says, if you look at that box very clearly, it says it’s the rendering provider’s ID so the doctor who’s actually performing the task, their NPI must go in box 24 j, that is really, really important. Now, I’m not talking about box 32, and box 33. That’s the location and billing information. That would be a lot of times your group NPI for that particular location, or where the billing payments would go. That’s different. That’s down below, I’m talking about the rendering provider ID do not bill under a single provider number, don’t do it. So, one it says rendering provider, so it actually has to be the person who’s performing that task.

So now we start getting into all the nuances of this and some of the problems. One is when you sign that claim form in box 31, you’re agreeing that everything on the claim form is true and accurate. And everything on the back all the statements on the back, one of the statements on the back is very, very, very clear. Any person who knowingly files a Statement of Claim containing any misrepresentation or false, incomplete, or misleading information, may be guilty of a criminal act, punishable under the law, and may be subject to civil penalties. So you know, of course, the consequences are grave. Additionally, there are additional liability problems that very well could arise with malpractice carriers and insurance. And if there’s a question of fraud, many times insurance carriers will back off because those are exclusions within your within your policy. And so frauds, the tough word isn’t always fraud, maybe, maybe not. It’s a question of intent. But quite candidly, if you’re trying to avoid finding out or I don’t want to know anymore, and so I’m just going to continue to do it the way I’ve always done it, or I’m just going to do it because this is how I was taught by my previous employer. All of those, you know, aren’t going to be defensible for the problem. They might be defensible for fraud, but let’s be honest, you would have to defend it which means it would be in court.

And so some people are saying, well, you know, how am I going to ever get caught? Well, here’s there’s a number of ways that that can happen. One is it just a simple random audit, no big deal, maybe a risk assessment audit, maybe it’s for the carrier not for you, with a claim form showing one provider is the rendering provider. Id identified on the claim form but then the note is signed by a completely different doctor. Now, if you’re also signing the documentation that was that was put together by the rendering provider. And you’re not that rendering provider that that you’re again, you’re you’re we’re going to be on dangerous grounds, most likely entering that ground of fraud. And so you have to be careful there. On the billing claim form bucks 24 j has to be the person who is actually performing the task. All of these things are important.

How else could you get caught? Well, let’s be honest if it’s all built under one provider, and maybe you have three associates that are working for you, that’s for doctors. Simple math says sometimes it just doesn’t work, that many adjustments, that many exams, and that many physical therapy activities, maybe there are timed codes that are happening. And the math doesn’t work to be able to justify payment, and that could trigger an audit as well. And so yes, these things are things that come up, we have seen this happen before where there’s recruitment, and although we have the 18, or soon to be at the beginning of next year, 12-month limit on recruitment, there is an exception to that rule, and that is when they can prove fraud. And so ultimately, if you’ve fraudulently submitted your claims, and again, in violation of what you agreed to when you signed box 31, with that knowingly filed a Statement of Claim containing misrepresentation or misleading information, all of that comes into factor. And if they’re able to prove fraud, then they can recoup well beyond that limited 18 or 12-month timeframe.

Really, the short answer is this weighed two things that matter. We can talk about two primary carriers because they make up the vast majority of the insurance world in Illinois, and that’s one, Medicare. Medicare allows you the moment that you have actually submitted your clean application for for participation in Medicare, you can begin to see Medicare patients, right, you hold your claims, and once you’re officially approved, then you can backbill back to the point of the application. Now, most carriers, and Blue Cross Blue Shield is one of them don’t necessarily have that rule, they want you to be fully credentialed. So until you’re fully credentialed by the insurance carriers, most of them you can check with each one but it appears a Blue Cross Blue Shield is one of them that requires you to be fully credentialed before you can actually bill as an in-network provider. Up until that approval point, you still are considered to be a non-participating provider. And so you’ll have to be a non-participant provider until that credentialing takes place. But don’t use a stopgap in the meantime and bill under the incorrect rendering Provider ID Number. This is really important. We see this a lot. Hopefully, this helps clear up some of the challenges that we see, bringing on new associates are how your billing practices work, and we will catch you next week. Take care.