Dry Needling Coding and Reimbursement for Chiropractic

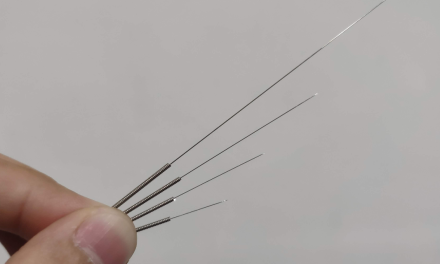

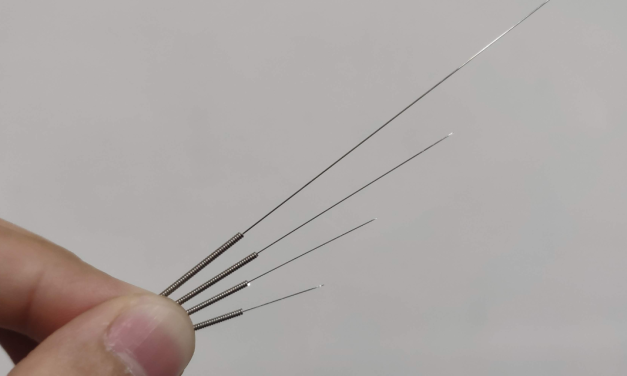

Dry needling can improve outcomes, but coding and coverage are complex. Learn ICD-10 and CPT 20560–20561 rules, payer limits, Medicare gaps, and how to avoid denials and compliance risk.

Read More