Medical Billing, Interest, and Collections

It seems simple: as a physician practice owner, you should be able to set fees for your services, provide the services, and collect payment for those services any way you can, correct? Unfortunately, as any physician managing a practice knows, it’s not that easy. Health care providers are no less affected by economic fluctuations than are other businesses, and some patients may pay bills slowly or not at all. Moreover, health care practitioners are also subject to state and federal regulations impacting their patient billing, as well as network provider agreements that also impact financial policies. You need to be assertive about the business aspects of your practice, but you must be especially careful about billing and collection activities because they can affect your license.

What are your options and obligations when patients don’t pay? Some laws, such as the Illinois Medical Patient Rights Act and Medical Practice Act, apply to all Illinois patients, regardless of the type health care plan. Other issues may be determined by the type of health care plan, as detailed below.

ILLINOIS MEDICAL PATIENT RIGHTS ACT

One reason that patients may not pay is because they have questions about a bill. Under the Medical Patient Rights Act, each patient has the right to examine and receive a reasonable explanation of the total bill for services rendered by the health care provider, including the itemized charges for specific services received. Each health care provider is responsible only for a reasonable explanation of those specific services provided by such physician or health care provider. This implies that the physician must make a legitimate attempt, commensurate with the complexity of the bill, to explain the charges. The Act does not, however, require the physician to obtain the patient’s agreement as to the charges. If a patient questions a bill, take the time to provide an appropriate explanation. If you are confident the charges are reasonable but the patient is still unsatisfied, document your explanation in the patient’s file.

ILLINOIS MEDICAL PRACTICE ACT

Although the Medical Practice Act is spare in specific references to billing practices, sufficient authority exists in the Act to discipline a physician for billing and collection violations. It is a disciplinary violation to engage in “gross and willful and continued overcharging for professional services….”. Therefore, physicians may not repeatedly and intentionally charge excessively high fees in comparison to similar practitioners. The Illinois Department of Financial and Professional Regulation generally does not get involved in simple billing disputes, but they can and have disciplined doctors under the “gross overcharging” provision. This section could conceivably also be used for practitioners who add unauthorized collection costs. The Medical Practice Act also has a general category for “dishonorable, unethical or unprofessional conduct of a character likely to deceive, defraud or harm the public,” which could be used to discipline the license of a physician who bills or collects in a deceptive or unethical manner.

PREFERRED PROVIDER AGREEMENTS /NETWORK CONTRACTS AND GOVERNMENTAL HEALTH CARE PROGRAMS

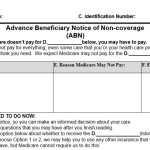

For services that are covered under the doctor’s preferred provider agreement with a health care plan, billing and collection will be governed by the agreement and the plan’s policies and procedures. For governmental health care programs, laws, rules, and regulations are established that will determine billing and collection procedures. In both situations, these written guidelines will limit what you can do, because you have agreed to those terms by participating in the plan. In general, the patient is only responsible for deductible amounts, co-payments, and coinsurance under these plans. The patient is also responsible for non-coveredservices, provided the doctor fulfills all requirements that may be imposed by the plan, such as notifying the patient of lack of coverage prior to treatment.

Therefore, if you have a collection problem with a patient who belongs to a network of which you are a member, the first place to look for guidance is your network contract. Those contracts usually establish terms for collection of co-payments and billing of patients. Check them carefully, as they often only permit doctors to bill for non-covered services if the patient was advised in writing prior to services being rendered that the services are not covered, and the patient agreed in writing to pay personally for the services. Of course, for covered services, the doctor is limited to billing at the rate prescribed by the network. For services that are covered by governmental programs such as Medicare or Medicaid, the corresponding laws, rules, and regulations will control how the physician may bill and collect for services.

PROMPT PAYMENT LAWS AND INTEREST DUE UNDER HEALTH PLANS

Providers who submit claims to third-party health plan payers are entitled by law to interest when payment is not timely. Third-party payers must pay claims within 30 days after they receive a claim with sufficient documentation. If the third-party payer believes the documentation is insufficient on the initial receipt of the claim (for example, cases where the payer requests additional information to prove medical necessity), the third-party payer must notify the provider within 30 days after receiving the claim. In those cases, the “clock” starts running when sufficient documentation is received. If the third-party payer does not pay the claim within 30 days after the claim is complete, the health care professional or health care facility is entitled to interest at the rate of 9% per year. Interest payments must be made within 30 days after the late payment. Interest of less than $1 need not be paid. Preferred provider agreements that attempt to have physicians contract away their legal rights to prompt payment and interest may be unenforceable because they are against public policy as expressed in these laws.

PROMPT PAYMENT LAWS AND INTEREST IN WORKERS’ COMPENSATION CASES

The legislature made changes in 2018 that allowed physicians to collect interest in workers’ compensation cases. The Workers’ Compensation Act requires employers to pay providers within 30 days of receipt of the bills, as long as the claim contains substantially all the required information. If the claim does not contain sufficient information, the employer or insurer must notify the provider within 30 days. When an employer or insurer fails to pay a properly submitted bill within 30 days of receipt bill, interest is due at a rate of 1% per month payable to the provider. Any required interest is due within 30 days after payment.

Medical professionals may file lawsuits to enforce interest payments from insurance companies on medical service workers’ compensation claims that are paid late. Essentially, this means medical providers, including chiropractic physicians, can take court action to enforce interest payments owed to them by insurance companies for workers’ compensation claims.

MAY PHYSICIANS COLLECT INTEREST FROM PATIENTS ON UNPAID BALANCES?

The ICS is often asked whether physicians may also charge their patients interest on unpaid balances. In general, interest may be added in business transactions only when there is an agreement to do so by both parties at the inception of the contract. Also, collection agencies in Illinois may not add amounts to the debt unless there was an agreement by the original parties. Therefore, if you want the ability to add interest charges in the future, or if you anticipate sending uncollected fees to a collection agency, it is advisable to get specific written authorization from your patients during the first visit. This authorization can be made part of your original signed patient financial agreement, which doctors typically require prior to the first treatment. The Illinois Interest Act provides that in all written contracts parties may stipulate to the interest of up to 9%. Thus, even when agreed to, interest may not exceed 9% per year by current law in Illinois.

In the absence of a written agreement to charge interest, the Illinois Interest Act may permit creditors to receive a 5% annual interest in some specific situations, a couple of which may apply in a physician’s office. The first is where the money is due to “settlement of accounts between parties.” If you review an outstanding account with a patient and the patient acknowledges the debt, this type of interest may be applicable, but only from the date of acknowledgment by the patient. Another possible justification for this type of interest is on the money “withheld by an unreasonable and vexatious delay of payment.” This theory is more difficult to prove and applies only when your patient has thrown obstacles in the way of collection or has deliberately induced you to delay taking proceedings to collect the debt longer than you would have otherwise done.

COLLECTION AGENCIES – TO USE OR NOT TO USE?

Like any other business, a chiropractic practice may wish to use a collection agency to pursue overdue patient accounts. Most of these collection agencies are paid a percentage of the amount collected. In the past, this fee structure was considered a technical violation of the prohibition against fee-splitting in the Medical Practice Act, because it amounted to dividing a professional fee with another party.

The law was changed in 2010 to clarify that physician licensees are permitted to pay a percentage fee to administrative, billing or collection agencies in exchange for their services, provided:

i) the licensee or the licensee’s practice at all times controls the amount of fees charged and collected; and

(ii) all charges collected are paid directly to the licensee or the licensee’s practice or are deposited directly into an account in the name of and under the sole control of the licensee or the licensee’s practice or deposited into a “Trust Account” by a licensed collection agency in accordance with the requirements of Section 8(c) of the Illinois Collection Agency Act. Therefore, if the above conditions are met, hiring a collection agency on a percentage compensation basis will not violate the Medical Practice Act.