Filing a Complaint Against Health Insurers with the Illinois Department of Insurance

The Illinois Department of Insurance has a process for health care providers to file complaints against health insurers. How does the process work? Let’s take a deeper dive into this.

Much of this information comes from the Division of Insurance website where a health care provider may file a complaint. After reviewing the process, you may file a complaint online.

To file a complaint, you must register with the department:

Here are the step-by-step directions to register.

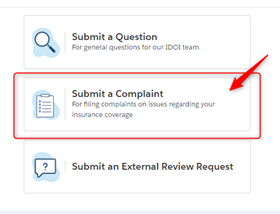

Once registration is complete, you may file a complaint online. However, you may also use this pdf “paper” complaint form.

Select “Submit a Complaint”

Then “Sign In” under Healthcare Provider:

The following information is important to understand regarding the Illinois Department of Insurance and the complaint process.

Record Maintenance

Well before you reach the point where you need to file a complaint, the Division of Insurance suggests that you keep documentation of when claims are submitted, maintain records of telephone conversations and written correspondence between you and the payer and post any payments to the account when they are received. You may not be able to prevent all problems with payers, but you will have the necessary documentation if you ultimately seek assistance from the Division of Insurance in obtaining payment for a claim.

Some of the matters the Division of Insurance has the jurisdiction to investigate and enforce include “prompt pay” requirements, claim denials, unsatisfactory claim payments (coding disputes and usual and customary fee reductions), provider contract disputes and utilization review. Although the DOI does not have authority to change the insurer’s decision in all instances, the DOI is able to review complaints, determine whether proper procedures were followed, and verify that the decisions were consistent with the insurance policy and with the law.

Timely Payment For Health Care Services – “Prompt Pay” Requirements

The Illinois Prompt Pay Law (215 ILCS 5/368a) requires insurance companies, health maintenance organizations (HMOs), and other payers such as managed care plans, preferred provider organizations (PPOs) and third-party administrators, to pay capitation amounts and claims within a specified time period. Failure to make payments within the required time entitles the health care professional or health care facility to receive interest (generally at the rate of 9% per year from the date payment was required to the date of the late payment). Note, however, the Prompt Pay Law does not apply to self-insured employers, trusts or insurance policies written outside Illinois. However, for out-of-state HMOs, the law does apply in certain situations if the HMO member is a resident of Illinois and the HMO has established a provider network in Illinois. If you have doubt in a particular case as to the applicability of the Prompt Pay law, call the DOI toll-free hotline at (877) 527-9431 and they will advise you.

The Prompt Pay Law refers to two types of payments:

- “periodic payments” include prospective capitation payments – the flat monthly fee that a health plan (such as an HMO) pays to a provider (doctor, hospital, lab, etc.) to take care of a patient’s needs;

- “payments other than periodic payments” – these are payments that require a claim, bill, capitation encounter data, or capitation reconciliation reports.

Periodic payments must be made by the health plan within 60 days after an insured or enrollee has selected a health care professional or health care facility or the date the selection becomes effective, whichever is later, and subsequent periodic payments must be made once a month. Other payments other than periodic payments, including regular claims for service, must be paid within 30 days after receipt of due written proof of loss.

Provider Contract Disputes

A provider contract with a health maintenance organization (HMO), independent practice association (IPA), physician-hospital organizations (PHO) or preferred provider arrangement (PPA), is a legal document entered into between two parties. Generally, the Division does not become involved in provider contract disputes, other than prompt payment of claims as outlined above. The terms of the contract will dictate the resolution of disputes. Failing that, you may want to seek individual legal counsel, especially in cases where the plan demands that you repay claim payments following a retrospective audit.

Claim Denial and Medical Necessity

If you believe a claim has been unjustly denied, the DOI will review your complaint to ensure the company is abiding by Illinois insurance laws and the policy language. Almost all insurance companies and HMOs require medical necessity as the basis for payment of claims. Usually “medical necessity” is defined by the policy and contains a reference to standards of good practice in the community for diagnosis or treatment of a covered illness or injury. As ICS members are too often aware, medical necessity is determined by the insurance company, and the DOI unfortunately does not have authority to review medical records and make an independent assessment of medical necessity. However, if an insurer or HMO denies a claim due to lack of medical necessity, the physician or patient may appeal the decision to seek DOI review of whether the payer has followed proper procedures required by State law.

For HMOS:

Appeal procedures for HMOs are set forth within the Managed Care Reform and Patient Rights Act. The patient or physician can file an oral or written appeal with the HMO. The Act requires an HMO to render a decision on an appeal for urgently needed treatment within 24 hours after submission of the appeal. All other appeals must be handled within 15 business days of receipt of all necessary information. If the appeal is denied, the patient is entitled to an external independent review. The patient, physician and the HMO select the independent reviewer jointly. The decision of the independent reviewer is final as to medical necessity, and if the reviewer determines the services to be medically necessary, the plan must pay for the health care services. If the reviewer decides that medical necessity was not proven, the patient-enrollee may appeal to the DOI to review whether the plan decision is consistent with the plan and Illinois law and rules. The DOI will review issues other than medical necessity, such as whether the decision was consistent with the plan regarding coverage for certain procedures and number of days of treatment.

Unsatisfactory Claim Payment (Coding Disputes and Usual and Customary Fee Reductions)

There are no Illinois insurance laws or rules regulating the compilation and use of usual and customary fee schedules or other fee methodologies. Insurers are allowed to define “eligible expense” or “maximum allowable expense” within the policy and to determine the method used to calculate payment for non-participating provider claims, including the percentile of usual and customary that will be paid. However, you may file an appeal with the insurer, and you may also file a complaint with the DOI.

Filing an appeal with the insurer:

- write a letter to the insurer explaining any extenuating circumstances or medical complications, and include all pertinent medical records and operative reports

- If the claim was paid based upon usual and customary provisions, the DOI suggests you consider contacting other providers in your geographic area and ask what they charge for the procedure in question.

- If your fee is equal to or less than what other area providers charge, the company may review that information and make a favorable adjustment, depending upon the percentile they use for usual and customary fee determinations.

Filing a complaint with the Department of Insurance:

- Although the Division cannot require a company to pay additional benefits, it can request that the company review the claim and give it further consideration

- The agency is willing to ask a payer to review a special situation that you believe has been handled inappropriately, but the agency is not equipped to handle volumes of complaints regarding disputed claim payments.

- Complete the provider complaint form and provide all documentation to support your position, including medical records and information regarding any special services provided to the patient that justify a higher fee or use of a different CPT® code.

- If the complaint is resolved, the DOI will close the file and send you a letter.

- If no violation of Illinois insurance law or rules is found, the DOI will send you a letter explaining why the investigation is being closed.