3 Takes: Hardship, DOT Physicals, Unprocessed Claims

Avoid legal trouble by using our financial hardship policy template, receive payments by directly resubmitting claims lost in the Change Healthcare cyber incident, and chiropractic physician participants in our upcoming course can qualify for certification to perform DOT physicals.

Referenced Links:

DOT Physicals

Hardship Waiver Article

Change Healthcare Unprocessed Claims

Transcript:

We’re going to cover three quick things that we want to put on your radar one is DOT physicals. Another one is information specific to the Change Healthcare cyber incident from back in February and another on financial hardship and some information that we recently published, that’s available to you. First, NRCME or the National Registry of Certified Medical Examiners. If you weren’t aware chiropractic physicians are included in the list of providers who can become certified to provide DOT physicals to commercial motor vehicle drivers. If you weren’t aware, there are 8 million CMV drivers across the United States. So there is a large population that desperately needs to have a DOT physical performed every two years. If you are interested in finding out more information about how this works for your practice, or how you can become certified, we actually have a course that’s upcoming and we want you to take a look at it. I’ll provide some information down below. It’ll provide you the education. Additionally, if you need your 10-year re-education, the class that we have coming up in June 2024, is available and will meet the requirements of NRCME for your 10-year recertification.

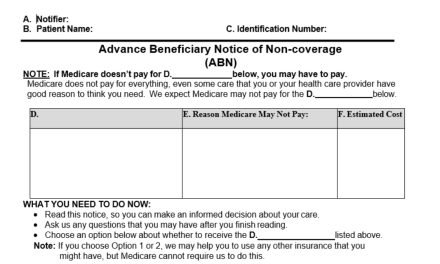

The second issue is financial hardships. As a reminder, if you’re just providing financial financial hardships without going through a process, or having a specific policy in place, you risk two things. One is having a dual fee schedule, or providing gifts and inducements, neither of which is legal in Illinois. So we want to encourage you to take a look at the information I’m going to put down below here. We actually produced an article recently that walks you through the process, what’s required, what you need to do, and some policies and procedures you can put in place in your practice in order to help those who desperately need your help, and who may not be able to afford it. And this is why we are putting out this information. And also, most importantly, we’re also providing a template. So you can download a policy template to be able to implement inside of your practice and tailor it to you with your specific situations and what you want to do. That is also included in that article. Again, we’ll link that down below.

The last has to do with the Change Healthcare cyber incident. All of you if you were impacted by the Change Healthcare fiasco, the cyber incident, the hacking incident that took place back in February, you need to go back and look at your claims that were submitted around that timeframe. And so it could have been plus or minus a couple of days, plus days really, in that February timeframe. Take a look if you have not received back your ERA35 or your electronic remittance advice, or your remittance, advices, or EOBs if you will, if you have not received those and you have not been reimbursed for that care during that timeframe, then there are steps that you need to take because some claims were lost in this process.

So here’s what we have been told. And we’ve talked to some experts to figure out exactly what steps you need to take. So there are three different case scenarios that you need to consider. One is Medicare. If you have been unpaid and you have unprocessed claims during that timeframe, you’re going to want to go in and actually directly submit those to NGS. Directly submit those to NGS of their Medicare claims, not Medicare Advantage, Medicare. Second is VA or the VA community care network unpaid and unprocessed claims. If you have unpaid and unprocessed claims there, you actually want to process those directly through Optum. Both of these scenarios are super important not to go back through your clearinghouse. That is where we’re seeing some problems. Experts in that area are telling us that if you try to resubmit their claim is most likely going to get rejected back into duplicate claim. And so the way that you go around it for the VA is to go directly to Optum. We’ve included a link in the article that’s linked down below.

Last is if you have claims that you’re running into the struggle with surrounding standard commercial insurance in those particular areas, you need to actually resubmit those claims either via paper or directly with that payer’s portal. And so they have a specific portal that you can submit your claims through. You need to directly put those claims through that portal or you need to actually do paper claims for those. Again, if you go through your clearinghouse, it’s going to get rejected as a duplicate claim so you don’t want to have that problem. So Medicare goes directly through NGS connects. VA goes to Optum directly, and lastly go directly through the portal or submit paper claims, only if you have have claims that have not been returned with the proper 835 or the remittance advices or the ERAs for that brief time frame it’s about a week or so back in February hopefully this information helps you out and we will catch you next week.