Time Limitation on Recoupment Demands

Editor’s Note: Recently, we announced the passage and signage of an Illinois law that will reduce the amount of time from 18 to 12 months after payment that insurance companies have to make recoupment demands. This law took effect on January 1, 2022.

It was not that long ago when insurance companies had no time limit when making requests for recoupment from medical providers. Some ICS members received insurance company recoupment demands for claims going back several years after the insurance company had paid the claims, and some of these demands exceeded a million dollars. Additionally, insurance companies were permitted to take offsets from future payments to pay for recoupments alleged to be due from previous payments, with no time limit as to how far back the insurer had paid the previous claims. Insurance companies sometimes refer to these recoupment amounts as “overpayments.”

In 2011, the ICS initiated legislation to limit the amount of time for which an insurance company could retroactively make a recoupment request. The ICS had the support of and worked with several other healthcare groups on this issue and was able to have the legislation pass overwhelmingly in the legislature. This legislation became effective January 1, 2012, under P.A. 97-0556, now part of the Illinois Insurance Code.

The law now prohibits insurance companies from requesting or withholding from future payments recoupment demands 12 months or more after the original payment on the claim was made. Essentially, this limited the time frame in which insurance companies could make a recoupment demand and provides some degree of financial closure for physicians. The ICS is aware of recoupment cases in which the amounts in controversy have been substantially reduced, because after the effective date of the law, insurance companies may only ask for refunds for payments made during the 12-month “lookback,” instead of demanding recoupment for years’ worth of payments.

The law incudes three exceptions: 1) when a court, government agency, other tribunal, or third party arbitrator has made a formal finding of fraud or material misrepresentation; 2) an insurer is acting as a plan administrator for the Comprehensive Health Insurance Plan under the Comprehensive Health Insurance Plan Act; 3) the provider has already been paid in full by any other payer, third party, or workers’ compensation insurer. In addition, federal law exempts the federal employee plan from this type of limitation.

What this means for physicians now is that, unless one of the above exceptions applies, insurance payments collected up to the previous 12 months are final and not subject to recoupment demands by the insurance company. For example, at the present time, all payments made up to and including January 2018 are covered by the 12-month rule and are final at this time. If you receive any refund or recoupment request for payments prior to January 2018, you should assert the rule to eliminate any amount paid before that date.

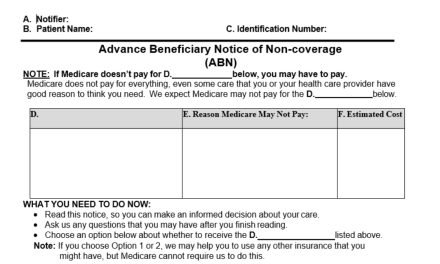

Insurance companies are also required to include and prominently display on the recoupment demand notification certain information, such as the name of the patient, date of service, service code, and the reason for the demand. This information helps to better inform medical providers about the insurance company’s allegations and helps providers defend erroneous recoupment demands. The law was a significant legislative accomplishment for the ICS, providing members with measurable financial closure regarding insurance payments.

If you have received a recoupment demand for claims that were paid more than 12 months prior to the request, notify the requesting insurance company in writing that their request is in violation of Illinois Statute 215 ILCS 5/368d. If the company persists in demanding refunds for claims beyond the 12-month limit, you can file a complaint with the Illinois Department of Insurance. However, since the legislation passed, the ICS has seen a significant decrease in the number of recoupment requests that reach past the 12-month limit.