The Fee Splitting Prohibition In Illinois

Most physicians know that physician “fee splitting” is prohibited, but many have only vague interpretations of the source and exact definition. In Illinois, the law is found in the Medical Practice Act, which says that doctors may not divide, share or split a professional fee in exchange for a referral or other services. Additionally, Illinois court opinions have consistently upheld the fee splitting ban. Despite some limited exceptions in the law (reviewed below), the basic rule maintains a strong footing in Illinois.

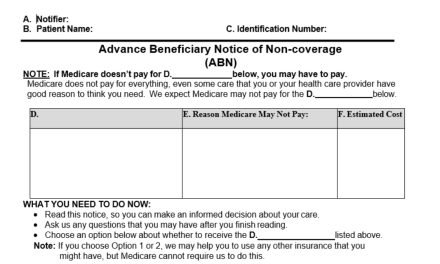

Although the federal government has similar “anti-kickback” laws applicable to patients covered by federally funded health plans (e.g., Medicare, Medicaid), the Illinois fee splitting law applies to all patients treated in Illinois, regardless of whether they are insured, uninsured, or covered by Medicare. Therefore, the same conduct could amount to violations of both state and federal law, potentially resulting in license discipline, civil penalties, and sanctions on, or termination from, participation in Medicare or Medicaid.

What is Fee Splitting?

Section 22.2 of the Medical Practice Act is titled, “Prohibition against fee splitting,” and states the general rule as follows:

(a) A licensee under this Act may not directly or indirectly divide, share or split any professional fee or other form of compensation for professional services with anyone in exchange for a referral or otherwise, other than as provided in this Section 22.2.

The language is often too-narrowly believed only to mean a ban on paying a commission to a non-physician in exchange for a referral — for example, paying a personal injury attorney a percentage of your patient’s fee in exchange for referring that patient. Of course, that arrangement would be illegal, but the prohibition is much broader and also includes dividing or paying a referral fee to anyone, which could include another health care provider. For example, it is impermissible for a chiropractic physician to refer surgical patients to an orthopedic surgeon in exchange for the surgeon “kicking back” part of the surgical fee to the D.C., or for the surgeon to refer post-surgical patients to the D.C. in exchange for the D.C. paying a portion of his/her fee to the surgeon.

Section 22.2 also extends beyond payments for referrals. It includes other services, such as marketing or being listed in a network or preferred provider organization, that may not be compensated by a percentage of professional fees (detailed below).

Also important is that prohibited payments may be “direct or indirect,” which means they may be in any form, including disguised value such as providing office space or services for less than fair market value. In other words, violations can occur even if the parties do not hand each other obvious, direct payments, but provide other items or services of value.

Why is Fee Splitting Prohibited?

Paying commissions for referrals is commonplace in most businesses. Of course, health care is more than just a “business,” and important considerations other than the bottom line come into play.

Simply put, it is believed that the physician’s professional judgment might be compromised by fee-splitting arrangements, because profit might take priority over the best interests of the patient. A doctor might be reluctant to provide necessary, but unprofitable, services if the fee must be shared, or conversely, might provide unnecessary but profitable tests and treatment because he or she will receive a large portion of the fee. This incentive is not present where payment to the physician is not tied to the volume of fees generated.

Courts Have Consistently Voided Percentage-for-Services Agreements

It is universally accepted that payments for referrals are illegal. However, Illinois courts have always gone even further by voiding percentage fee splitting, by or with physicians or non-physicians, for a number of other services. Using this standard, Illinois courts have voided agreements for physicians to pay a percentage of fees for marketing services, management services, the sale of a medical practice and participation in a network of health care providers. In fact, under a prior version of the Medical Practice Act, a court went so far as to void the common arrangement for collection agencies to be paid a percentage of the professional fees collected. The case resulted in the legislature amending the Medical Practice Act to allow this type of collection arrangement and to clarify other aspects of fee splitting.

Fee Splitting Under the Current Medical Practice Act

In 2009, the Illinois legislature created a new section 22.2 to the Medical Practice Act to codify one separate section of the Act for fee splitting. This provision added an exception to permit percentage medical billing arrangements, incorporated court rulings, and otherwise elaborated on the fee-splitting prohibition.

Section 22.2 starts by saying that a licensee “may not divide, share or split a professional fee or other forms of compensation for professional services with anyone in exchange for a referral or otherwise, other than as provided in…Section 22.2.” This is the legislature’s way of affirming the general prohibition against fee splitting in Illinois. It also ratifies prior court holdings that any kind of fee sharing arrangement not specifically authorized by statute is prohibited. For that reason, physicians need to conform closely to this provision; creative arrangements designed at expanding on the statute will probably not survive regulatory scrutiny. Section 22.2 describes arrangements that comply with the Medical Practice Act. Everything not expressly authorized is prohibited, and the Act names a few of those specifically, as detailed below.

What is Permitted Under the Medical Practice Act Section 22

The amended fee-splitting provision provides the following exceptions, in which dividing fees is permitted:

- Section 22.2(b) acknowledges the right of licensed individual health care workers to each receive adequate compensation for concurrently rendering services to a patient, provided the patient has full knowledge of the division of fees and the division is made in proportion to the actual services personally performed and responsibility assumed by each licensee. The previous version of the statute limited this exception to physicians; under this version, the division may occur among licensed health care professionals.

- Section 22.2(c) permits pooling, sharing, dividing or apportioning of fees among physicians who practice within entities such as medical corporations, professional service corporations, professional associations, limited liability companies, entities owned solely by physicians (such as sole proprietorships and partnerships), entities such as hospitals and physician-owned ambulatory surgical centers, and joint ventures of these physician practice entities.

- Section 22.2(e) permits the granting of a security interest in the accounts receivable or fees of a licensee for bona fide advances made to the licensee, provided the licensee retains control and responsibility for collection of the accounts receivable and fees.

- Section 22.2(d) permits a licensee to pay fair market value to another entity for billing, collection, or administrative preparation of claims, based on a percentage of professional service fees billed or collected, a flat fee, or any other arrangement that divides professional fees, provided that: 1) the licensee or the licensee’s practice controls the amount of fees charged and collected, and 2) all collected fees are paid directly to the licensee or are deposited directly into a trust account by a licensed collection agency. This new language now makes it clear that traditional percentage billing and collection services are permitted as long as these conditions are met.

What is Not Permitted Under the Medical Practice Act Section 22.2

The general prohibition prevents dividing a fee with anyone or any entity unless the arrangement falls into one of the listed exceptions. Of course, this still includes paying any person for referrals of business. In addition to the numerous other compensation arrangements that could be inferred from the general prohibition, the recent amendment specifically prohibits the payment of a percentage of the licensee’s professional service fees, revenues or profits for the following specific services:

- Marketing or management of the licensee’s practice

- Including the licensee or the licensee’s practice on any preferred provider list

- Allowing the licensee to participate in any network of health care providers

- Negotiating fees, charges or terms of service or payment on behalf of the licensee, or

- Including the licensee in a program whereby patients or beneficiaries are provided an incentive to use the services of the licensee.

Percentage compensation agreements for many of these services were considered and struck down by Illinois courts even prior to the fee-splitting amendment, further evidence that the legislature intended to agree with the courts’ determination that they are unlawful.

Impact of Section 22.2 on Employee Associate Physician Contracts

The ICS is often asked whether a physician clinic owner may employ an associate physician under a percentage compensation arrangement, i.e., where the associate is paid a percentage of gross or net fees for patients treated by the associate. The discussion under this heading refers to associates who are true W-2 employees as defined by the Internal Revenue Service. (see ICS article regarding the distinction between employees and independent contractors.)

Section 22.2(b) permits an owner and associate (or any licensed health care workers) “….to each receive adequate compensation for concurrently rendering services to a patient and to divide the fee for such service, provided the patient has full knowledge of the division and the division is made in proportion to the actual services personally performed and responsibility assumed by each licensee…” Most experts interpret “dividing” a fee to mean a percentage fee split, which this section allows if certain conditions are met:

- The providers concurrently render services. This is easily met in an employer-employee arrangement, because the employer by definition controls and oversees the associate employee’s work.

- The patient has full knowledge of the division. This requirement is arguably met by implication where a patient is treated by an employee associate – the patient may infer that the fee will be apportioned to pay the associate’s salary. The requirement could also be more definitely met by including a sentence in the patient’s financial agreement stating that the office will apportion fees, including payment of associate physician salaries, according to law.

- The division is made in proportion to the actual services personally performed and responsibility assumed by each licensee. This requirement may be met where the percentage payment is reasonably related to the work performed by each physician. For example, where the owner physician is very involved in patient co-management, oversight and review of the associate’s work, correct diagnosis, treatment plans, and coding of procedures, a higher percentage is more justifiable than where the owner is not as involved in “micromanaging.” By definition, all employer physicians will perform at least some services and assume responsibility for their employee associates.

Of course, the next question is the definition of “personally performed services.” At this time, we do not have a published Illinois court opinion on the specific types of “personally performed services” that qualify to allow a percentage split of patient fees. Some authorities believe it is sufficient if the physician clinic owner reviews billing or assumes legal liability by providing the services in the clinic. Others believe the interpretation is less generous and that both physicians must actually treat the patient. For physician owners who wish to greatly minimize their risk of running afoul of the fee splitting provision, a flat fee arrangement, in the form of an hourly rate or per patient amount (irrespective of the patient fee), is the safest way to avoid a contract challenge based on illegal fee splitting.

Impact of Section 22.2 on Independent Contractor Physician Contracts

By the I.R.S. definition of an independent contractor, it is far more difficult to establish the Section 22.2(b) requirements above to use a percentage compensation arrangement with an independent contractor physician. Physicians might co-manage patients, but it would be difficult to establish a fixed percentage that would be appropriate for the division of work in each case. Because each case is different, one set percentage will not likely be in proportion to the actual services personally performed and responsibility assumed by each licensee in each case. Another problem arises if the owner physician does not provide any patient services but has agreed to take on responsibility, liability, and control of the contract physician’s work to justify taking a percentage of the contractor’s professional fees. This arrangement looks more like true employment because of the degree of the owner’s responsibility and control, which is not present for a true independent contractor. The mischaracterization runs afoul of I.R.S. regulations and could subject the owner to back employment taxes and penalties.

The ICS recommends that owner physicians review their contractor arrangements to make certain they meet I.R.S. requirements to qualify as independent contractors. If so, they may use an expense sharing agreement with contractor physicians (rather than a professional fee-sharing arrangement) to appropriately divide and apportion office expenses.

Employment of Allied Health Care Personnel Permitted Under Medical Practice Act Section 22.3

In reviewing the practice acts of other licensed health care personnel, the Department of Financial and Professional Regulation historically construed the fee-splitting provisions very strictly. In particular, the Department reviewed the Physical Therapy Act and raised a concern that its broad fee-splitting provision prohibited physical therapists from being employed by anybody other than another physical therapist or physical therapy entity. The same reasoning would prohibit employment of other health care licensees by physicians.

To resolve the issue, the legislature added Section 22.3 to the Medical Practice Act that clearly states physicians, physician practices and entities that are authorized by law to employ physicians may also employ other licensed health care workers and other persons. The same legislation also amends the fee-splitting provisions in a number of health care license practice acts to clarify that those provisions do not affect any bona fide independent contractor or employment arrangements among health care professionals, facilities or providers, and that any employment arrangements may include provisions for compensation, health insurance, pension or other employment benefits in exchange for the provision of services under the scope of the licensee’s practice. The amendment also clarifies that an employment arrangement is not required to receive professional fees for services rendered.

The addition of Section 22.3 removed any perceived legal impediment to the employment of allied health care licensees by physicians, or to independent contractor relationships between physicians and other health care licensees, as long as these arrangements otherwise meet the requirements of Section 22.2 of the Medical Practice Act.

Billing and Collection Services

The Medical Practice Act creates a specific exception that allows billers and collection services to be compensated on the basis of a percentage of professional fees, so long as the licensee controls the amount of fees charged and collected and that all collections are paid directly to the licensee or a licensed collection agency’s trust account. This provision was added to codify usual and customary practice in the collection industry. It is limited to billing and collection functions only and does not apply to physician compensation arrangements.

The Bottom Line

Although the fee-splitting provisions of the Medical Practice Act allow for some exceptions, they do not change the underlying rule for any arrangement that does not fit into a specific permitted category. The basic prohibition against fee splitting is still very much alive and well in Illinois, and noncompliance remains dangerous.

From a business perspective, employment or contractor agreements may be voided because they violate the fee-splitting prohibition, leaving you with no means of enforcing the terms of an agreement. In addition, business disputes often result in the filing of complaints with the Illinois Department of Financial and Professional Regulation, which could result in license discipline, up to the loss of a license, for violation of the Medical Practice Act. Those possibilities should be enough motivation for physicians to use great caution in crafting any agreement calling for an illegal division of professional fees. The real-life financial impact to providers can be enormous, because the cases usually arise out of business disputes where a provider alleges the other party has not lived up to the terms of the agreement. If the agreement is later voided, the provider is left with no basis to be compensated for the other party’s poor performance.

The best advice is found in Section 22.2 of the Medical Practice Act itself: any kind of fee sharing arrangement not specifically authorized by statute is prohibited. Heeding that advice will keep you compliant and your license and business agreements intact.