The False Claims Act – OIG Compliance

Dr. Evan Gwilliam explains the False Claims Act and its importance for OIG compliance, detailing how to maintain legal integrity in healthcare billing.

You can learn more about the False Claims Act here.

Transcript:

Hi there, I am Dr Evan Gwilliam. I’m the Senior Vice President at Practisync, and I’m a certified professional compliance officer, among other things. You are watching this video because you are working on your OIG Compliance Plan, and as such, we suggest that you become familiar with at least five big federal laws that are core to OIG, or Office of the Inspector General compliance. The first of those five is the False Claims Act, and in this video, we will explain to you what you need to be aware of as a healthcare provider to stay compliant with this particular law.

Healthcare Fraud is a serious problem. It’s estimated that fraud, waste, and abuse, cost taxpayers $30 to $100 billion a year. Aside from money lost patients might be exposed to unnecessary services, and then that money is no longer available for legitimate care for others. Fraud is defined as obtaining something of value through intentional misrepresentation or concealment of material facts. Waste is incurring unnecessary costs as a result of deficient management systems or controls, and abuse is excessively or improperly using government resources for things like unnecessary care or having excessive prices. An example might be billing for chiropractic manipulative treatment when the patient wasn’t even in the office that day. That’s fraud. Or billing Medicare for maintenance visits as if they were active care. That’s abuse.

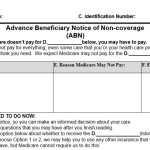

The government has asked healthcare providers and their teams to partner in preventing fraud, waste, and abuse. The False Claims Act makes it illegal to submit false claims or fraudulent claims for payment to Medicare or Medicaid. The claim would be considered false if the service wasn’t actually rendered or was already paid, miscoded, or not supported by the record. For violations, the fine is up to three times the amount lost, plus $11,000 per claim. So it adds up pretty quickly. The way the rule is written, it doesn’t matter if you intend to defraud the government. If you hide your head in the sand and complain that you just didn’t know the rules, you’re still liable. And there’s also a whistleblower provision so that anyone can report the violation and violation and they can be entitled to a portion of the recovery money. And this is all just part of the civil law. There are criminal criminal penalties, possibly too, which could include more fines and imprisonment. And if all that doesn’t motivate you to take a closer look at this law, then you ought to know that the Office of Inspector General has laid out guidelines that state that you need to have an explicitly documented policy procedure in place to make sure your clinic is complying with the False Claims Act.

So what can you do to show you’re a good law abiding chiropractor? One, conduct and document regular billing and coding reviews to make sure that you’re not breaking any rules. You can hire a consultant to do that, or it can be done internally, but it needs to be documented either way. Two, if you find a mistake, then you pay the money back within 60 days. Every office should have an OIG compliance manual that has things like this written into the policy and procedures section, but that’s only the first step. The second is that providers must actually do what they write about in the manual. It’s actually not that hard to stay compliant with the False Claims Act, and it can actually save the clinic money by avoiding the consequences of a mistake. So that is the first law that you should be aware of in considering your OIG compliance The False Claims Act.