Medicare’s Quality Payment Program

Medicare’s Quality Payment Program: Getting Paid for Value Instead of Volume

The government has become increasingly concerned with how it spends money in the healthcare sector. As part of the latest proposal to fix this problem, the Medicare Access and CHIP Reauthorization Act (MACRA) was passed in 2015. This law changes reimbursement to remunerate providers more when they provide high-quality care rather than just more care. It rewards value over volume. It also ends the flawed Sustainable Growth Rate (SGR) formula that had been in use to determine Medicare payment for many years, and it combines three other quality-based programs into one. Its biggest and lasting impact may be how it influences the way that patients select the providers they choose to see.

However, many providers do not have to participate in this new program in 2017. If you are in your first year of practice, OR you don’t see over 100 Medicare (CMS) beneficiaries in 2017 or you bill Medicare $30,000 or less in allowed charges, participation is optional. Nonetheless, this model is the beginning of a whole new way to get paid for healthcare, and not only does Medicare have plans to expand it, but private payers are likely to follow someday. Even if you choose not to participate in 2017 because you don’t have to, you need to know what the future holds.

There are three more reasons why you should consider participating in this value-based payment model:

- Maybe you don’t see enough Medicare patients now, but the threshold could be dropped next year, or even sooner. If you understand how the program works before it is required, you will be able to approach it with less stress.

- The administrative burden of reporting is not that high if you have already grown accustomed to Meaningful Use and PQRS. MACRA changes these programs but does not add much to them. You will continue to do the same things, but under a program with a different name.

- Your performance rating will become publicly available at sites such as Medicare’s Physician Compare. Imagine a potential patient who sees that you are rated with no stars, but your nearest competitor participated and got four stars. Whom do you think the patient is more likely to choose?

MACRA and the Quality Payment Program

In October of 2016, CMS released the final rule for implementing the Quality Payment Program (QPP) as mandated by MACRA. The rule is over 2400 pages. Half of that consists of responses to comments on the proposed rule that came out six months earlier. Fortunately, CMS has been very sensitive to feedback on the proposed rule. They have reduced the criteria and extended the timeline to make it easier for providers to get in line.

The Quality Payment Program offers two tracks to providers: Advanced Alternative Payment Models (APMs) and the Merit-based Incentive Payment System (MIPS). Advanced APMs require 25% of payments to come from CMS or 20% of patients to be seen through an Advanced APM in 2017. These entities take on some risk related to patient outcomes and CMS estimates that about 100,000 clinicians will qualify the first year. MIPs is a gateway program into this model. Advanced APMs will likely not apply to most chiropractic physicians.

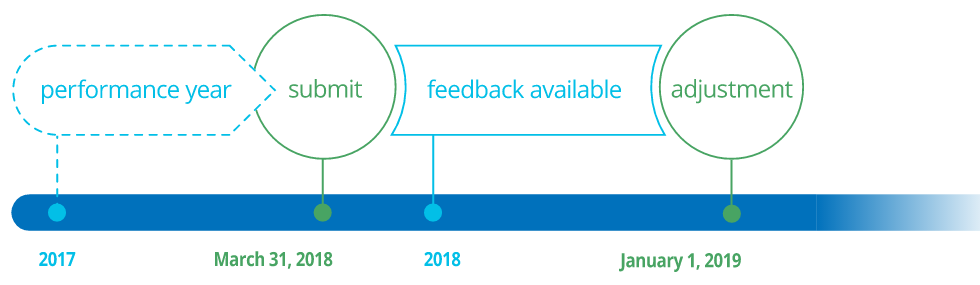

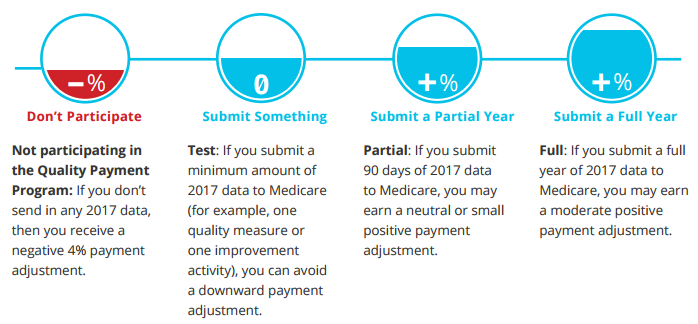

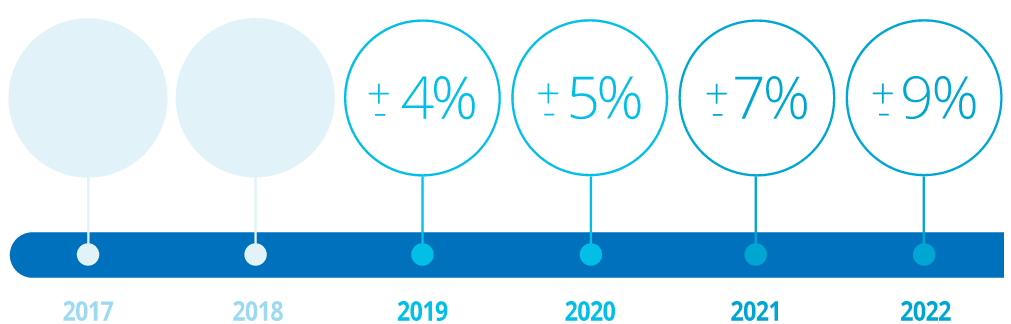

In 2017 about 500,000 providers will participate in MIPS, under which clinicians can earn a performance-based payment adjustment to Medicare reimbursements. It will be focused on evidence-based and practice-specific quality data and depends on how much data is submitted and the performance score (see Figure 1). If you are eligible but choose not to participate in 2017, you will receive a 4% negative adjustment in 2019. If you submit one measure, you can avoid a downward payment adjustment. If you submit for 90 days during 2017, you may earn a neutral or small positive adjustment. And, if you think you have this system figured out and you submit a full year of 2017 data to Medicare, you may earn a moderate positive payment adjustment (see Figure 2). The penalty and reward increases each year to a current maximum of 9% in 2022 (see Figure 3). You have until March 31, 2018, to submit your data, but most small practices will likely submit via their EHRs or on claims, so data should be provided to CMS as care is delivered.

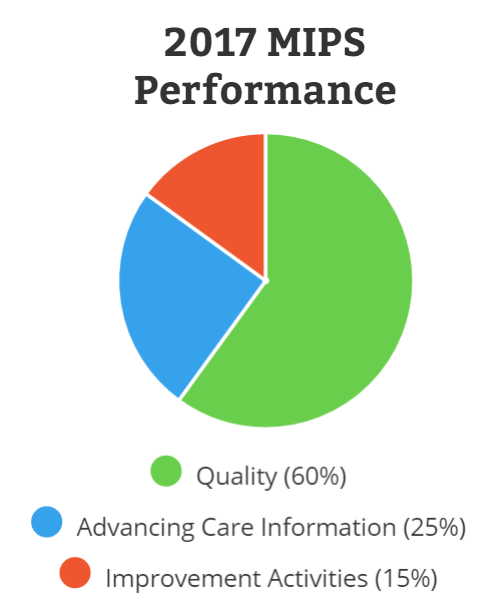

You can participate as an individual if you have a single NPI tied to a single tax ID, or as a group, if you share a common tax ID with other providers. Some parts of MIPS are reported via your certified EHR, if you have one. Other categories of MIPS may be reported via claim forms or a certified registry. MIPS is divided into four categories and combined into a composite performance score, which will be made publicly available to help beneficiaries make informed decisions. The categories are as follows:

Quality

This category is worth 60% of your 2017 performance score (see Figure 4). It replaces the Physician Quality Reporting System (PQRS). If you have participated in PQRS for Medicare beneficiaries in the past, then you have little to worry about. It appears that you will continue to do the same thing, only the program now has a different name. You should report up to six measures, one of which must be an outcomes measure. If no outcomes measure applies to your specialty, you can choose a high priority measure instead. There are 271 measures from which to choose. The measures can be searched at qpp.cms.gov by specialty. It appears that the same two measures that were reported under PQRS will continue to be the only ones that are applicable for chiropractic in 2017.

Advancing Care Information

This category, worth 25% of your score (see Figure 4), replaces the Medicare EHR Incentive Program, also known as Meaningful Use. You may not need to submit Advancing Care Information if the measures do not apply to you. There are two measure sets, depending on the edition of your EHR. Either one has five measures that are required for the base score, but you can submit up to nine measures for additional credit. The five base score measures are:

- Security Risk Analysis

- e-Prescribing

- Provide Patient Access

- Send Summary of Care

- Request/Accept Summary of Care

If a measure doesn’t apply, then you would not report it, and it would not be included in the calculation of your score, such as e-Prescribing. Your EHR vendor should be a good resource for helping you select the best measures for you to report.

Improvement Activities

This category is the one that is brand new, and it only makes up 15% of your 2017 performance score (see Figure 4). It does not replace any existing program but focuses on care coordination, beneficiary engagement, and patient safety. Medicare lists 93 activities from which to choose, 14 of which have a “high activity weighting.” Most providers will need to report on four, and this will likely be done via EHR or an approved registry. Examples include information about patient satisfaction, tobacco use, and engagement of family members.

Cost

This category replaces the Value-Based Modifier, but it will not be counted in the 2017 score. Regardless, the provider does not have to do anything, because this information will come from the dollar amounts on claim forms. If you can provide lower cost care than your peers, you will receive a higher score in 2018, but this will only count as 10% of the score.

What now?

If you are not required to report on MIPS because you are too small, don’t worry about it. But it might be a good idea to at least consider reporting Quality Measures (formerly PQRS) as you always have. Minimal reporting will cancel out the possibility of a negative adjustment. In fact, take the time to learn a little more and report the Improvement Activities and Advancing Care Information for 90 days in 2017 as well. It might earn you a little bonus in 2019. You can start as late as October 2, 2017.

Check out your status at portal.cms.gov. There you can access your Quality Resource Utilization Report (QRUR). It will identify cost performance, quality performance, specialty adjusted benchmarks, PQRS/MIPS measure performance, and episode costs for a given tax ID number. Essentially your QRUR can tell you how you would be scored if MIPS were enacted today. Some of the data from this report will go onto Medicare’s Physician Compare web site so that potential patients can see how you compare to your peers. Think of it as the Consumer Reports or “Yelp!” of healthcare.

Our healthcare system is in need of an overhaul. It is hoped that the Quality Payment Program will address some of the problems and change provider behavior for the better. Medicare has promised to be flexible and listen to feedback. They expect the program to adapt in the future. But they also realize that there are only a few ways to change clinician behavior: pay them more, improve their satisfaction and help them avoid public humiliation (such as poor quality scores posted on a public website). MIPS pays them more, consolidates multiple other government programs, and provides flexibility to give clinicians every opportunity to make their quality scores look good.

Dr. Gwilliam, Vice President of ChiroCode, graduated from Palmer College of Chiropractic as Valediction and is a Certified MIPS Quality Professional, Certified Professional Coding Instructor, Medical Compliance Specialist, and Certified Professional Medical Auditor, among other things. He provides expert witness testimony, medical record audits, consulting, and online courses for health care providers. He also writes books and articles for trade journals and is a sought-after seminar speaker. He has a Bachelor’s degree in accounting and a Master’s of Business Administration. Find out about new developments in QPP and MIPS at ChiroCode.com.