Medicare Fee Schedule and Locality

Where can I find the Medicare Fee Schedule?

You can find the current fee schedule for Medicare here: Latest Medicare Fees. Select “Medicare Physician Fee Schedule Pricing” in the first drop down.

Then select “Specific to Fee Code” followed by the date of service, CPT® code, and Illinois locality under Region (see below). Click Search.

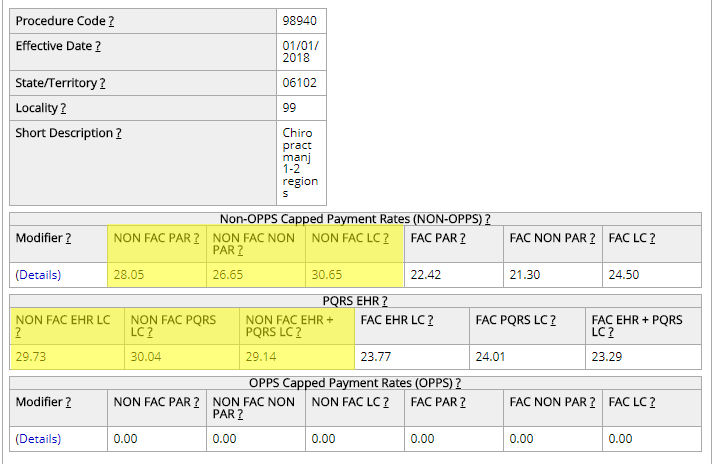

Below is an example of the results.

The portion that will apply to the vast majority of our doctors is found in sections as highlighted below.

- NON FAC PAR = Participating Fee

- NON FAC NON PAR = Non-Participating Fee

- NON FAC LC = Limiting Charge for Non-Participating Providers

- NON FAC EHR LC* = Limiting Charge for Non-Participating Providers with EHR non-compliance penalty

- NON FAC PQRS LC* = Limiting Charge for Non-Participating Providers with PQRS non-compliance penalty

- NON FAC EHR+PQRS LC* = Limiting Charge for Non-Participating Providers with both EHR and PQRS non-compliance penalties

* 2018 is the last year that providers will see a penalty for EHR and/or PQRS non-compliance. These programs are rolled into the MIPS program. Remember, the information below is for reference purposes ONLY.

Which locality am I?

If you are uncertain as to your locality, Medicare divides the different states into several geographic Localities based on the location of your practice. Illinois consists of payment localities 12, 15, and 16, and 99. A listing of the counties comprising each payment locality follows:

Locality 12

- Bond

- Calhoun

- Clinton

- Jersey

- Macoupin

- Madison

- Monroe

- Montgomery

- Randolph

- St. Clair

- Washington

Locality 15

- DuPage

- Kane

- Lake

- Will

Locality 16

- Cook

Locality 99

- All other counties