Strategic Health Solutions Audits Chiropractic Medicare Records

Strategic Health Solutions, a contractor working for Medicare, is auditing chiropractic records throughout the United States. Many doctors in multiple states, most recently Illinois, have received requests to send in records in response to a Medicare audit conducted by Strategic HealthSolutions. This round of audits is a Centers for Medicare and Medicaid Services (CMS) initiative to request, receive and review medical records through its Medicare Contractors, including Strategic Health Solutions. All physicians have the responsibility to ensure that Medicare-reimbursed items and services are reasonable and necessary, and, when asked for documentation, to provide it in a timely manner. Knowing how to respond when documentation is requested will lead to better chances of successful audit defense.

CMS uses data mining, claims information, and utilization comparison records to profile providers. Data mining occurs primarily when you send in a claim form. Strategic Health Solutions (Strategic) is performing a medical review of records through the project Y4P0434 for Chiropractic Services. Documentation will be reviewed for compliance on such issues as a medical necessity, maintenance care, and signature requirements. Once the review process is completed, the provider will receive a post-payment report outlining the findings.

Claims Adjustments

CMS will direct claims adjustments and recoupment efforts. In addition to identifying underpayments or overpayments, claims may be subject to extrapolation in keeping with the CMS regulations. This means they will use strategic statistical sampling to extrapolate amounts to be repaid from claims beyond those that are under direct review. The extent of the anticipated extrapolation is unknown, but money can be recouped for payments made up to six years prior.

Once the review is completed, the doctor will receive a review results letter containing information regarding the claims and the specific findings associated with these claims. If the doctor determines there is additional information or documentation relevant to supporting the payment of the denied claims, the doctor may submit the additional information and documentation. All additional information must be submitted within a 30-day submission period.

Take Action

If you receive such a letter, we suggest you take the following steps: First, do not procrastinate. You need to gather the information together and send it to the auditor by the due date. If you are unable to comply with the due date, call the number provided and request an extension. In most cases, we have found that they will grant a two-week extension.

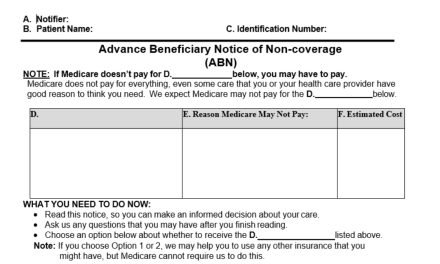

Second, please contact your malpractice carrier immediately. You may have coverage for audit defense which may include attorney’s fees and other audit defense costs (not fines or recoupment amounts). We recommend that you send information not only the dates requested but any other information and notes that will support the care for those dates. Think of each chain of treatment for a condition as an episode. The first date of an episode of care should have initial information on the history, findings, diagnosis and treatment plan. You will want to send the initial report, SOAP notes, re-evaluation findings and report, radiology reports, outcome assessment tools, claim forms and ABN forms. Make copies of all correspondence and send all this information with a tracking number.

Do Not Change Your Notes

If you wish to clarify any entries, provide an addendum to clarify the information provided. DO NOT change your notes. That may be construed as fraud. Remember, all notes must be signed. If your note is not signed legibly, it may be denied. You can attach a signature attestation form.

Once you get the results of the audit, study and learn from it. If you disagree with the findings, consider an appeal. If money is being recouped from you, you may appeal. Keep in mind that chances are good that CMS may come back in the future to audit you again to ensure that you have corrected your deficiencies identified.

Conclusion

Lastly, if you need help, reach out for help! If you have further questions, call us to help you get through this. Not all is lost. Learn, evolve, and provide ethical, medically necessary chiropractic care for your patients.