Understanding ERISA Law: How to Appeal ERISA Claims

A large number of questions I receive deal with appealing denied insurance claims and these denials cause most doctors headaches. When a claim has been denied because of medical necessity or because a service is not covered, an important step in the appeals process is to determine if the patient’s plan is a self-funded ERISA plan.

ERISA

ERISA stands for the Employee Retirement Income Security Act passed by Congress in 1974. (1) Determining if a patient’s insurance plan falls under ERISA law can be difficult because a network such as BCBS can be used to pay claims under an ERISA policy as well as a non-ERISA policy. ERISA regulations only cover “self-funded” plans provided by private employers. Non-private plans provided by government agencies, Medicare, Medicaid, public schools, workers compensation, military, churches, individually purchased insurance plans and fully insured plans are some examples of plans not covered under ERISA law.

An employer whose insurance plan is self-funded pays for each claim out of its own funds. This differs from a fully insured plan where the employer pays the premiums to an insurance company and the insurance company covers the employee and their dependents. An employer who has a self –funded plan assumes the direct risk for payment of benefits and usually has a large cash flow.

ERISA law sets the standards for how self-funded private employee health benefit plans are administered, how financial and other information is disclosed to the beneficiary and how claims are processed. ERISA law also establishes appeal regulations that allow beneficiaries the right to appeal the denial of treatment and appeal claims that are denied and not paid. The regulations also require the employer’s plan administrator to cite the sources used when making a claim decision and the credentials of the claim reviewer. (1)

Why would a company or corporation choose to be self-funded? There are several benefits for an employer who self-funds their own insurance plan:

- The employer does not have to follow many individual state health insurance regulations and mandates. They can have the same policy across state lines. In most cases ERISA law supersedes state law, and, as a result, the Illinois Department of Insurance will not investigate complaints that deal with policies under ERISA law.

- The employer can customize their health care plan to fit their employee’s needs, which is more difficult with a purchased insurance policy.

- The company or corporation can control the money in their health care reserves maximizing interest income and improving cash flow since they do not have to pre-pay for coverage.

- The employer can contract with insurance providers to process their claims. (2)

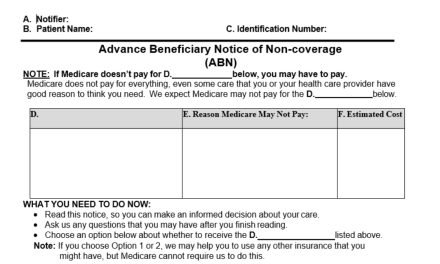

So by now, you are probably wondering why all this information is important to you as a practitioner and business owner. Well, if you understand how to appeal claims under ERISA law then you can increase your cash flow. When a claim under ERISA law is denied, it is important to understand why the claim was denied. Was it denied based on the plan’s written rules and guidelines? If so, then the rule or guideline must be referenced in the EOB or denial notice. Was the claim denied based on medical necessity? If this is the case, the beneficiary must be provided with a clinical reason for the decision and also receive the name and qualifications of the health care professional who made the claim determination.

Appeal

A beneficiary has the right to appeal any denied claim as outlined in the Summary Plan Description (SPD), or the patient can decide to allow you to act as an authorized representative and appeal the claim on the patient’s behalf. If you decide you want to act on behalf of the patient, the first step in the appeals process is to become an authorized representative. It is important to remember ERISA rights belong to the patient, and the doctor can only obtain the right to act on the patient’s behalf in pursuing appeals if the doctor has become the patient’s authorized representative. The general assignment of benefits a doctor has a patient sign is not considered adequate to authorize the doctor to act on the patient’s behalf, so it is important to have a separate “Assignment and Designation of Authorized Representative” form signed by the patient.

By becoming the patient’s authorized representative, you the doctor gains the power to access the information needed to appeal a claim. Upon completion and presentment of the Assignment and Designation of Authorized Representative form, the ERISA covered plan must now provide all the plan’s information and notifications to the doctor allowing him or her to act on the patient’s behalf. Once a doctor has become the authorized representative he or she has the same rights as the patient in the appeals process.

This includes:

- Access to all documents used in the claims process.

- The right to obtain a copy of the plans SPD at no cost, as well as obtain specific references from the SPD used in claim denials.

- The right to appeal on the patient’s behalf. The appeal cannot be based on previous judgments, and the individual who made the initial denial or any subordinates cannot review the appeal.

- The right to have a qualified health care professional, in the appropriate field, review the claim.

- The right to file suit against the ERISA plan provider in federal court. (This is only done when all proper steps in the appeals process have been exhausted.)

When forwarding the Assignment and Designation of Authorization Representative form to the ERISA plan administrator, include a cover letter explaining that you are now an authorized representative and that you are requesting a copy of the SPD. Once you have obtained authorization and have received the SPD, you can now appeal the claim. First, use any forms the plan has for filing appeals, and make sure you address the appeal to the attention of the administrator.

Your appeal should include (if applicable):

- A statement that an appeal is being filed

- A copy of the Authorization Form that states you are authorized to make the appeal

- The provider name, address, phone number, NPI number

- The beneficiary’s name, address, phone number, DOB, plan ID, and group number

- Any documentation that was in question during the initial denial including:

• daily SOAP notes,

• a patient treatment plan,

• exam findings and/or a statement of medical necessity. - A copy of the patient’s EOB.

- The doctor’s signature and the date.

As the patient’s representative, you should send the appeal certified mail to the attention of the plan administrator, send a copy to the patient, and put a copy in the patient’s file. If your appeal is denied and you have exhausted all your insurance appeals, you can file an appeal or complaint with your regional Employee Benefits Security Administration (EBSA office).

Additional Resources

The ICS has sample ERISA appeal letters on our website that can assist doctors with their appeals. By providing our members with these forms, we hope to make the appeals process easier for our members and increase their income.

Important Definitions and Resources

Assignment and Designation of Authorized Representative

Request for Summary Plan Description

Request to Legal Department or Request to Forward to Legal

Letter of Appeal Post Service Claim:

Lack of Medical Necessity Insufficient Information Provided by Plan to Respond

Lack of Medical Necessity Sufficient Information Provided by Plan to Appeal

Plan Exclusion Request for Summary Plan Description Only

Letter of Appeal Pre-Service Claim:

Lack of Medical Necessity Insufficient Information Provided by Plan to Respond

(1) U.S. Department of Labor, Employee Benefits Security Administration www.dol.gov/ebsa

(2) Self Insured Health Plans, Self-Insurance Institute of America, Inc.