OIG Recommends 24-visit Cap For Medicare

In June 2005, the Department of Health and Human Services, Office of the Inspector General (OIG) released an analysis report on chiropractic utilization in Medicare. In the report, analysis was made on data from 2001. The findings revealed that 57 percent of these services did not meet Medicare coverage criteria. In addition, 16 percent were miscoded or billed at the wrong level of spinal manipulation, and 6 percent were undocumented. Medical reviewers determined that the majority of inappropriately paid services were maintenance treatments ($186 million in allowed payments), which Medicare defines as medically unnecessary, and are therefore not covered. Another 14 percent ($65 million) were found to be medically unnecessary for other reasons. Medicare also allowed $24 million for services billed with a spinal manipulation code that were actually extraspinal manipulations or non-manipulative treatment, such as massage. Apart from coverage issues, upcoding was also a significant problem, resulting in a $15 million overpayment. Based on the findings in the analysis report, the OIG has recommended a 24-visit “hard cap” on chiropractic visits. This recommendation has been met with strong opposition from the American Chiropractic Association.

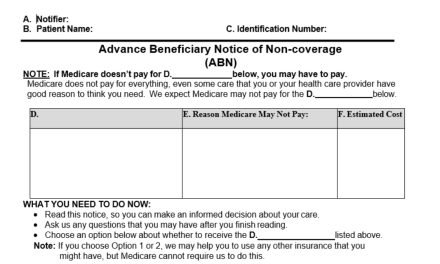

The analysis put forth is, in my opinion, extremely flawed in their assumptions and conclusions. The American Chiropractic Association has also released a statement in opposition to the report. You may view their statement on the ACA Web site at: http://www.acatoday.com/government/medicare/Response.shtml. CMS requires that the provider submit all covered services for reimbursement. All services other than manual manipulation of the spine for treatment of subluxation are excluded when ordered or performed by a doctor of chiropractic. Chiropractors are not required to bill excluded services to Medicare. CMS considers spinal manipulation always to be a covered service. However, manipulation for maintenance purposes is not considered to be medically necessary by Medicare.

For years, chiropractors have been faced with the dilemma of the requirement to submit claims for spinal manipulation, even if the provider had determined the care to be maintenance in nature. Inquiries to CMS and the local carrier yielded no solution. It was not until October 1, 2004, that the AT modifier became effective. It was at this time that the provider was finally given the opportunity to declare to CMS if the care was for maintenance purposes or active therapeutic care. The report glosses over this fact. Clearly, the AT modifier has given the profession an opportunity to reduce the “maintenance care” error rate.

In another matter, the OIG stated, “…as chiropractic care extends beyond 12 treatments in a year, it becomes increasingly likely that individual services are medically unnecessary. The likelihood of a service being medically unnecessary increases even more significantly after 24 treatments. Accordingly, identifying and carefully scrutinizing services beyond a certain frequency threshold could result in significant savings. Although frequency-based controls are common among carriers and in the private sector, the Centers for Medicare & Medicaid Services (CMS) do not have a national policy addressing their use.”

Medicare beneficiaries frequently present to the chiropractic office with chronic conditions. The CMS carriers’ manual states, “Chronic spinal joint condition (e.g., loss of joint mobility or other joint problems) implies of joints have already “set” and fibrotic tissue has developed. This condition may require a longer treatment time, but not with higher frequency.” The Office of Inspector General has discriminatorily indicated possible fraud, or at least overutilization in the chiropractic profession, while the CMS manual acknowledges that chronic spinal joint conditions require a longer treatment time. I feel that their reactions are inflammatory to say the least. For more accurate information, further analysis should be made on claims submitted after the introduction of the AT modifier in April 2004. In addition, patient satisfaction surveys and outcome assessment tests should be analyzed.

The OIG admits in their report that the chiropractic error rate contributes minimally to the overall CERT national paid claims error rate. Out of the approximately $191 billion for Medicare fee-for-service claims in 2001, chiropractic claims accounted for only $500 million, or 0.26 percent of the total amount. Is the OIG missing the “Big Picture?”

Based on the number of e-mail, fax and telephone inquiries I receive, the chiropractic providers are clearly making an effort to understand and meet the Medicare requirements. Interestingly, a 2004 study of the CMS provider help centers by the Government Accounting Office (GAO) found that 96% of the time, answers by CMS to billing questions are incomplete, only partially correct or totally inaccurate. This does not lend an atmosphere of error reduction.

The profession does concede that documentation and Medicare guideline understanding is important. The Illinois Chiropractic Society (ICS) has gone out of their way over the last several years to educate doctors and their staff as to proper documentation guidelines and an awareness of the Medicare requirements. Over two dozen continuing education classes were produced by the ICS pertaining to documentation and Medicare in 2004 alone! In addition, the ICS has produced audio educational classes on Standard Medicare and Medicare Demonstration Project guidelines. The ACA has also developed a documentation manual that attempts to address this problem and has been included by a number of schools in their curriculum. Chiropractors are encouraged to accurately assess their patient’s status pertaining to maintenance visits, to accurately file claim forms and document accordingly.

As a profession, we must be diligent in achieving and maintaining proper documentation of necessity of care. Look for future classes scheduled to address the documentation issue of Medicare. Doctors and their staff are all encouraged to attend classes available through the ICS. In addition, for easy reference, chiropractors are encouraged to purchase the above-mentioned educational materials for reference material in their office and staff training.

Editor’s Note: This article was written prior to the deadline. Currently, ICD-10 is the only standard for submitting diagnosis codes on claim forms.