CMS Reports Lower Chiropractic Documentation Error Rates

By John Falardeau, American Chiropractic Association

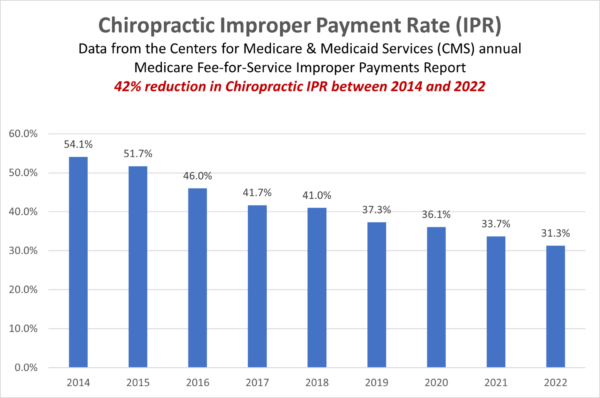

The American Chiropractic Association (ACA) has taken great strides in the past several years to help chiropractors improve Medicare documentation by providing resources aimed at bringing down error rates that could lead to improper payments. According to government records, these education efforts are bearing fruit, as latest figures show a 42% reduction over the last eight years in the chiropractic Improper Payment Rate (IPR).

In 2002, the Improper Payments Information Act (IPIA, P.L. 107-300) was enacted, which requires federal agencies to estimate and report an annual amount of improper payments for all programs and activities. The Centers for Medicare and Medicaid Services (CMS) estimates the Medicare Fee-for-Service (FFS) program improper payment rate through the Comprehensive Error Rate Testing (CERT) program. The CERT contractor calculates three types of improper payment rates: (1) contractor-specific improper payment rates, (2) improper payment rates by provider type, and (3) a national improper payment rate. According to CMS, the contractor-specific improper payment rates are used to assess Medicare Administrative Contractor (MAC) performance in paying claims accurately. The provider-specific rates are used to assess how well providers are complying with Medicare’s billing and coding requirements.

Improper payments occur for a number of reasons, but there are three root causes for most improper payments: (1) documentation and administration errors, (2) authentication and medical necessity errors, and (3) verification errors. Documentation and administration errors occur when Medicare lacks the supporting documentation necessary to verify the accuracy of the provider or suppliers’ claim for federal payment. Authentication and medical necessity errors occur when Medicare is unable to confirm that a provider or supplier met the criteria for payment, such as when a service was not medically necessary given a patient’s condition. Verification errors happen when information is not checked to be sure that it is current and accurate, even though the information exists and is accessible. In 2022, 63.6% of improper payments were due to insufficient documentation. (1)

As you see in the chart below, improper payments were attributed to over 54% of all Medicare FFS claims related to chiropractic in 2014. However, in 2022, that number was reduced to just over 31%, a 42% reduction in the chiropractic Improper Payment Rate (IPR).

The reduction in the IPR can be attributed to two factors: 1) ACA has taken a vested interest in developing relationships with the MACs, and 2) ACA has increased access to educational resources to help doctors of chiropractic improve their Medicare documentation. For example, ACA members have exclusive access to many resources on the ACA website in the Practice Resources/Medicare section. The association also offers several webinars on Medicare coding and documentation that are available to all chiropractors through its Learn ACA platform. Two new Medicare programs added to Learn ACA in recent weeks include “Introduction to PART Documentation” and “Error-free Medicare and Billing Procedures: 4-Part Series.”

Chiropractors exhibiting proper documentation should drive the IPR even further down in coming years, and this decrease will only look more favorable in the eyes of legislators, as we work to pass the Chiropractic Medicare Coverage Modernization Act (H.R. 1610 and S. 799). The bill would allow Medicare beneficiaries access to the chiropractic profession’s broad-based, non-drug approach to pain management, which includes manual manipulation of the spine and extremities, evaluation and management services, diagnostic imaging and utilization of other non-drug approaches that have become an important strategy in national efforts to stem the epidemic of prescription opioid overuse and abuse.

Included in the bill’s language is a provision that states that chiropractors will be able to bill Medicare for the full scope of their services allowed by their state, provided they have completed documentation training in the form of a one-time webinar or similar process, as determined by CMS. This is another layer of training we believe will again only help the IPR numbers and will not be too burdensome for participating chiropractors.

Visit the Advocacy/Medicare section on the ACA website for further information on the Medicare bill and learn how you can help secure its passage.

John Falardeau is senior vice president of public policy and advocacy at the American Chiropractic Association.

References

- 2022 Medicare Fee-for-Service Supplemental Improper Payment Data, Centers for Medicare and Medicaid Services, https://www.cms.gov/httpswwwcmsgovhttpswwwcmsgovresearch-statistics-data-and-systemsmonitoring-programsmedicare-ffs/2022-medicare-fee-service-supplemental-improper-payment-data

The Illinois Chiropractic Society republished this article with permission from the American Chiropractic Association.